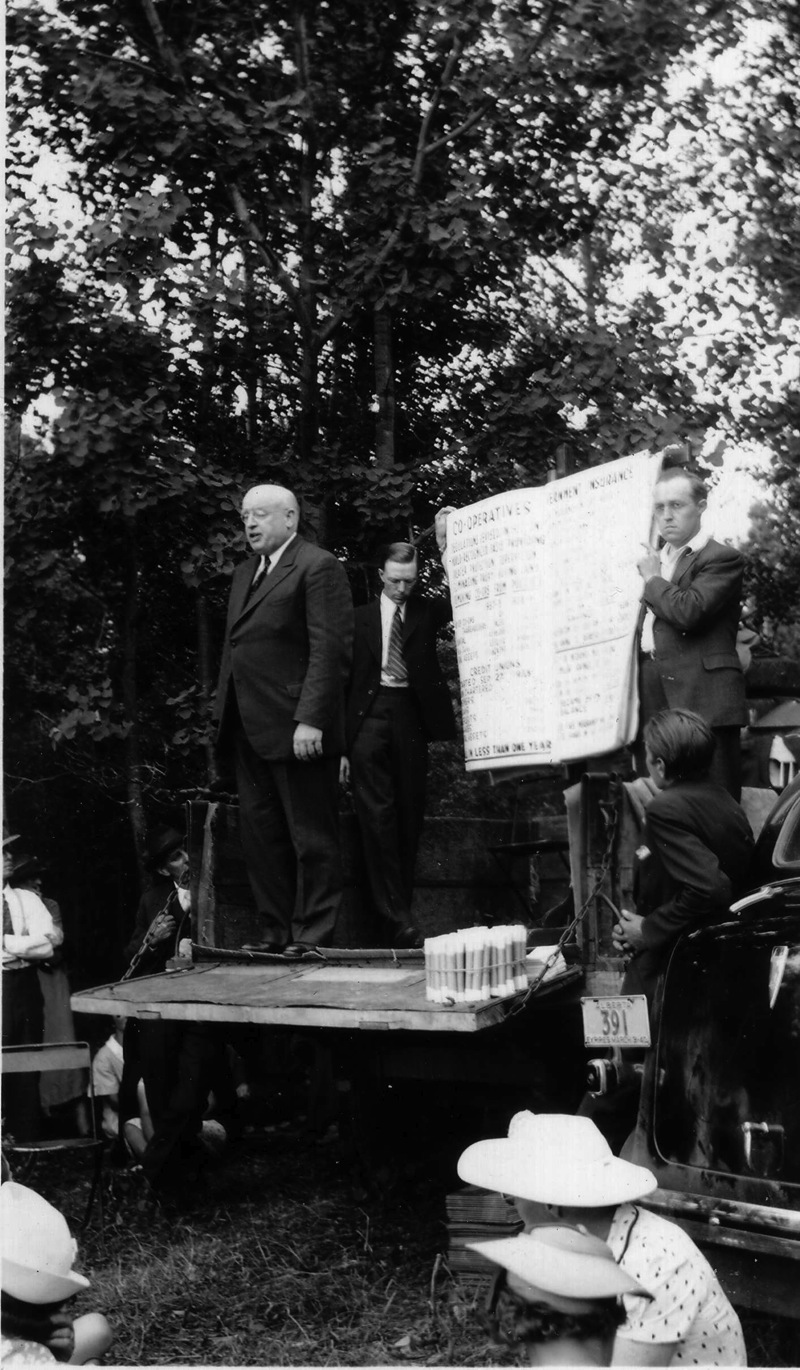

The travails of Alberta after it defaulted on its debt serve as a cautionary tale for American politicians now on the brink. An excerpt of author Brian Brennan’s feature in Facts and Opinions today:

On October 17, 2013, the American government could enter unchartered territory. If Congressional Democrats and Republicans cannot agree on raising the statutory borrowing limit known as the “debt ceiling,” the government could be forced to default on its financial obligations. What would that mean for the rest of the world? Nobody knows for certain. Such a crisis scenario is virtually without precedent in modern North America. Some analysts say a default could trigger a global financial heart attack similar to the one caused by the 2008 collapse of Lehman Brothers, a sprawling global bank. Others claim a default wouldn’t be that bad, because America always has enough tax money coming in to pay its debt service.

We do know from history that a government’s failure to meet its debt obligations can have ramifications well beyond the borders of the realm where the default takes place. At the very least, it means the defaulting jurisdiction is locked out of international financial markets. Argentina was shunned by capital markets for a decade after defaulting on $81.8 billon (U.S.) of sovereign debt in 2001. The western Canadian province of Alberta was an outlier for nine years after admitting its inability to redeem $3.2 million (Cdn) of maturing provincial bonds in 1936.

Read the rest of Brennan’s feature in the Dispatches section, with a $1 day pass for the entire site, or by subscription.